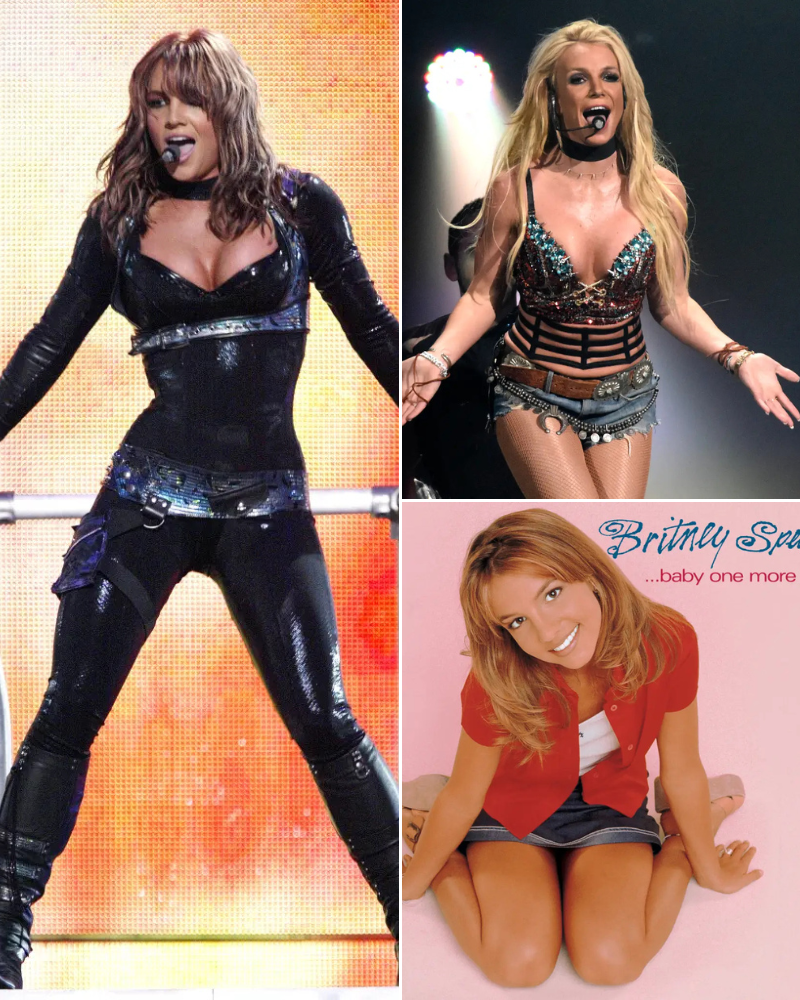

Britney Spears has reportedly entered a landmark nine-figure agreement to sell her iconic music catalog, marking a significant financial and strategic shift for one of pop music’s most recognizable figures. Industry observers describe the transaction as a major development not only for Spears but also for the broader trend of legacy artists monetizing their intellectual property.

The reported deal involves rights associated with Spears’ extensive catalog of recordings and publishing interests, which include some of the most commercially successful pop songs of the late 1990s and 2000s. From her breakout hit “…Baby One More Time” to chart-topping singles such as “Toxic,” “Oops!… I Did It Again,” and “Womanizer,” Spears’ catalog has generated substantial revenue across streaming platforms, radio play, licensing, and synchronization deals.

While financial details have not been publicly confirmed in full, sources characterize the agreement as being valued in the nine-figure range. Such deals have become increasingly common in recent years as investment firms, music publishers, and entertainment companies seek to acquire established catalogs that offer predictable long-term revenue streams.

Music catalogs are often viewed as stable assets. With the continued expansion of streaming services and global music consumption, classic hits can generate consistent royalties decades after their initial release. For investors, purchasing rights to well-known catalogs represents an opportunity to secure steady returns tied to enduring popularity.

For Spears, the sale comes at a pivotal time in her career. Following years of legal battles surrounding her conservatorship, which ended in 2021, the pop star has been reasserting control over her personal and professional affairs. The catalog sale may reflect a broader effort to restructure her financial portfolio and simplify long-term asset management.

Industry analysts note that artists often sell catalogs for various reasons, including estate planning, liquidity needs, diversification of assets, or strategic realignment. A lump-sum payment can provide immediate financial flexibility while transferring the responsibility of catalog administration to a corporate entity.

Spears’ catalog holds unique cultural significance. Emerging in the late 1990s as a teenage pop phenomenon, she quickly became one of the best-selling artists of her generation. Her debut album alone sold millions of copies worldwide, establishing her as a defining voice of turn-of-the-millennium pop.

Over the years, Spears’ music has remained relevant through streaming resurgence, social media trends, and nostalgic revival among younger audiences. Viral dance challenges and renewed radio rotation have introduced her hits to new generations of listeners. This sustained engagement enhances the long-term value of her catalog.

The deal also reflects a broader industry pattern. In recent years, numerous high-profile musicians have sold portions or entirety of their publishing rights and master recordings. Analysts attribute this wave of transactions to favorable market conditions, historically low interest rates in prior years, and strong valuations for music intellectual property.

Although Spears is reportedly selling her catalog rights, such transactions do not necessarily prevent an artist from performing their music live. Performance rights are typically governed separately. However, ownership of masters and publishing rights can influence licensing decisions for film, television, advertising, and digital platforms.

Representatives for Spears have not issued an extensive public statement detailing the motivations behind the deal. As with many catalog transactions, confidentiality clauses may limit disclosure of precise terms.

From a branding perspective, the sale underscores Spears’ enduring market power. Despite periods of personal and professional turbulence, her catalog continues to command substantial financial interest. The reported nine-figure valuation signals investor confidence in the longevity of her music.

Financial experts suggest that catalog sales can serve as wealth preservation tools. By converting future royalty streams into immediate capital, artists reduce exposure to market fluctuations while securing guaranteed compensation. The trade-off involves relinquishing control over how the catalog is commercially exploited.

Spears’ career has spanned more than two decades, encompassing global tours, multiple studio albums, award recognitions, and cultural milestones. Her influence extends beyond music into fashion, entertainment, and social media discourse.

The landmark deal may also impact how her music is curated and marketed moving forward. Corporate ownership often brings expanded licensing strategies, reissue campaigns, and synchronization placements designed to maximize asset value.

As the music industry continues evolving in the digital era, catalog ownership has become a focal point of artist empowerment debates. Some artists seek to retain full control, while others opt to monetize their assets strategically. Spears’ reported sale reflects one possible path among many.

Ultimately, the nine-figure agreement marks a new chapter in Britney Spears’ financial and artistic journey. While ownership of her catalog may have shifted, the songs themselves remain embedded in pop culture history.