Insights into the Investment Moves of Bill & Melinda Gates Foundation Trust for Q2 2024

Bill Gates (Trades, Portfolio), a titan of industry and philanthropy, submitted the 13F filing for the second quarter of 2024, revealing strategic adjustments in his investment portfolio managed under the Bill & Melinda Gates Foundation Trust. Gates, who co-founded Microsoft in 1975 and was the world’s richest man for 15 consecutive years, now focuses on guiding investment managers to align with the principles of good governance and the philanthropic values of his foundation.

Bill Gates Amplifies Berkshire Hathaway Stake in Latest 13F Filing

Key Position Increases

During the second quarter of 2024, Bill Gates (Trades, Portfolio) made notable adjustments to his investments, including an increase in several key positions:

The most significant increase was in Berkshire Hathaway Inc (NYSE:BRK.B), where Gates added 7,317,105 shares. This adjustment boosted his total holdings to 24,620,202 shares, marking a substantial 42.29% increase in share count and a 6.24% impact on his current portfolio, with a total value of $10,015,498,170.

Summary of Sold Out Positions

Bill Gates (Trades, Portfolio) also made decisive exits from certain investments in the same quarter:

He completely sold out his position in Carvana Co (NYSE:CVNA), offloading all 520,000 shares, which resulted in a -0.1% impact on the portfolio.

Key Position Reductions

Reductions were also part of Gates’ strategy this quarter:

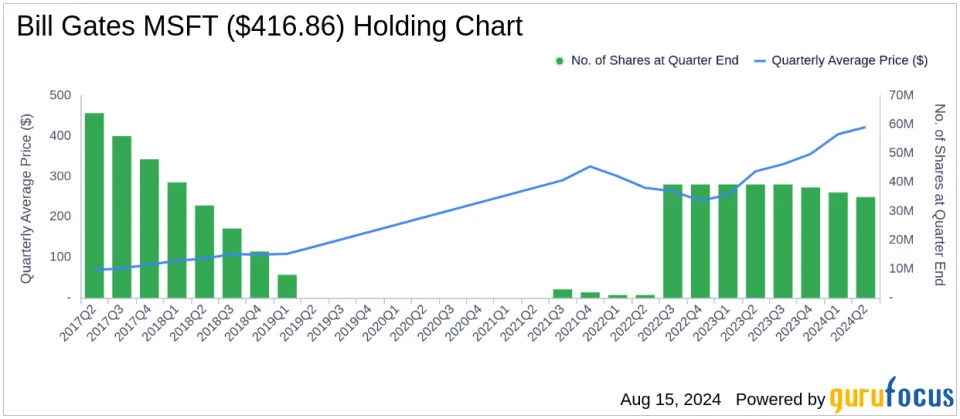

The portfolio saw a significant reduction in Microsoft Corp (NASDAQ:MSFT), with 1,610,000 shares sold. This move decreased the share count by -4.41% and impacted the portfolio by -1.48%. During the quarter, Microsoft traded at an average price of $422.32, returning 0.25% over the past three months and 11.26% year-to-date.

Portfolio Overview

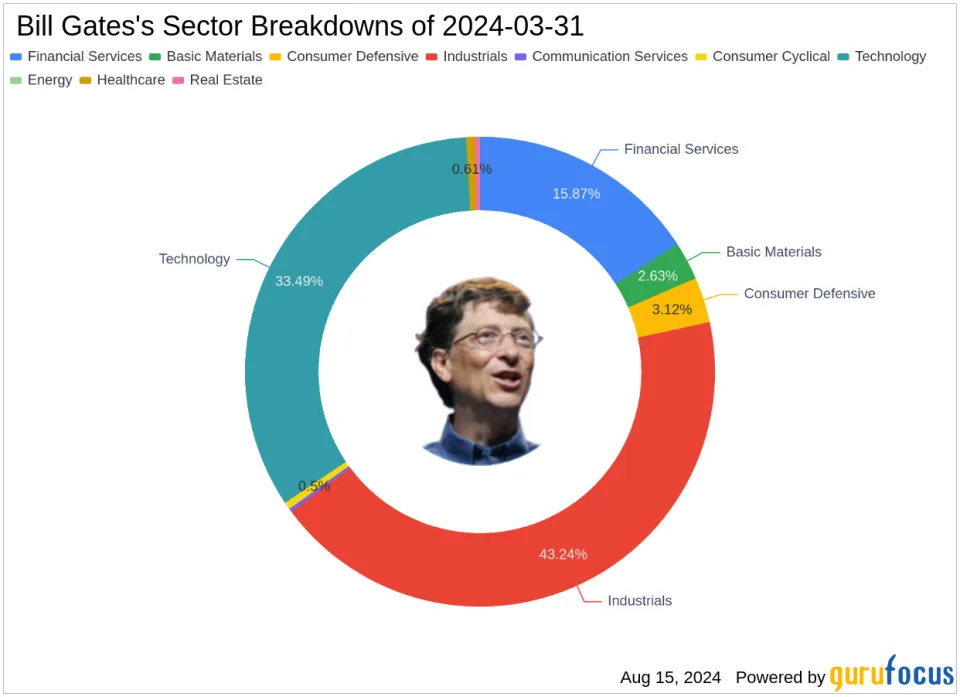

As of the second quarter of 2024, Bill Gates (Trades, Portfolio)’s investment portfolio comprised 23 stocks. The top holdings were notably concentrated in several sectors, reflecting a diverse and strategic approach to asset allocation:

32.71% in Microsoft Corp (NASDAQ:MSFT)

21.01% in Berkshire Hathaway Inc (NYSE:BRK.B)

15.77% in Waste Management Inc (NYSE:WM)

13.59% in Canadian National Railway Co (NYSE:CNI)

5.14% in Caterpillar Inc (NYSE:CAT)

The investments span across nine industries, including Industrials, Technology, and Financial Services, showcasing a broad interest in various sectors of the economy.

Bill Gates Amplifies Berkshire Hathaway Stake in Latest 13F Filing

Bill Gates Amplifies Berkshire Hathaway Stake in Latest 13F Filing

This detailed look into Bill Gates (Trades, Portfolio)’s latest investment moves provides valuable insights for value investors and market watchers, highlighting trends and strategies in high-profile asset management.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.